Purposeful Wealth

I idolized my late grandfather. To me, he was the embodiment of all the best qualities and traits of the Greatest Generation. I didn’t know the younger version of him – the one who designed aircraft for the Navy during WWII, built his first two homes himself, almost became a Lutheran minister and then managed a furniture store for 30+ years. I knew the retired version, the one with an easy smile and ready laugh who was always happily busy doing something. What I remember most about him is not all the things he did but how he did them. My grandfather did everything with purpose. It didn’t matter if he was shooting pool, making a tray in his woodshop, driving the family to the NJ shore for the day – my grandfather was always completely present and focused in the moment. He was one of the happiest people I have ever known, and as I’ve gotten older I’ve come to believe that his happiness flowed from his unfailing ability to be perfectly connected to where he was and what he was doing.

It is tempting to reduce retirement down to numbers. “I want to have $X at 65.” “When I have $X, then I can retire.” “Could I retire if I had $X?” Many of us play this game. It’s human nature and it’s often necessary. Money comes in handy when it’s time to pay a medical bill or buy groceries. Others take this further though and put together intricate spreadsheets of their investments and overall net worth. These spreadsheets are then updated regularly and stared at even more frequently, as if the screen is some sort of magic mirror from a Disney movie, capable of telling its viewer in a soothing voice: “You won, look how much money you have!” But do numbers on a screen really show that one is “winning”? If you believe that money is ultimately just a means to an end, not an end in and of itself, then what one does with their wealth – how connected one is to their daily life, their hopes, and aspirations, the people in their lives – that is the real test of winning.

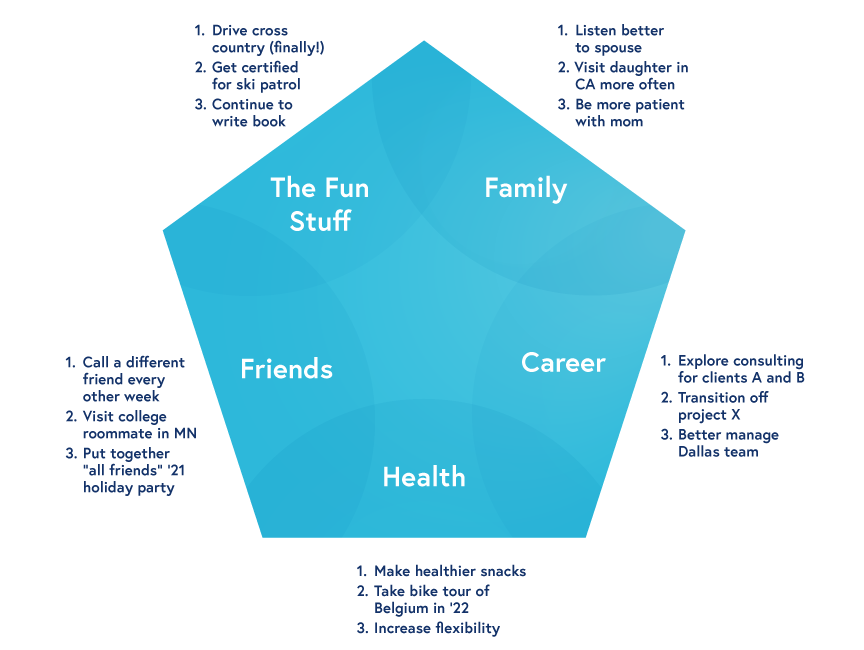

So if you’re retired, thinking about retirement, and even if you’re not, put the spreadsheet off to one side and instead draw the story of your life. In The Merry Wives of Windsor, Shakespeare wrote that there is a divinity in odd numbers, so I suggest drawing a triangle or a pentagon. Next to each of the sides, define in a word or a few words the most important things in your life and/or the things you most want to accomplish. These shouldn’t be “bucket list” places to see or things to do. These should be short categorical descriptions of what matters most to you. Below those headings bullet out three ways you are going to enhance that aspect of your life or achieve that goal.

Here’s a sample.

Once you’ve sketched this out, scan it every morning or evening for a week or two. Chances are, reminding yourself what is most important to you will better anchor you in the moment, and it may even change what you do and how you spend your time. Update this as your life changes, make it bigger or smaller, share it with others, and most importantly, look at it and think about it at least as much as you do at a spreadsheet of your assets and the website for your accounts.

Many hope their retirement years will be more meaningful than their working years. Wealth can make that possible but it has to be used and used purposefully. So put together a spreadsheet of your wealth and check your accounts religiously if you must, but pay at least as much attention to the things in your life that will never be captured by a dollar sign.